The financial industry is undergoing a significant transformation, driven by the rise of Decentralized Finance (DeFi) and the groundbreaking capabilities of blockchain technology. As traditional financial systems face increasing challenges related to inefficiencies, lack of transparency, and high fees, DeFi offers a promising alternative—one that democratizes financial services, eliminates intermediaries, and ensures a more inclusive, transparent, and secure financial ecosystem.

In this article, we will explore how blockchain technology is fueling the rise of DeFi and revolutionizing the financial industry, ushering in a new era of financial innovation.

What is Decentralized Finance (DeFi)?

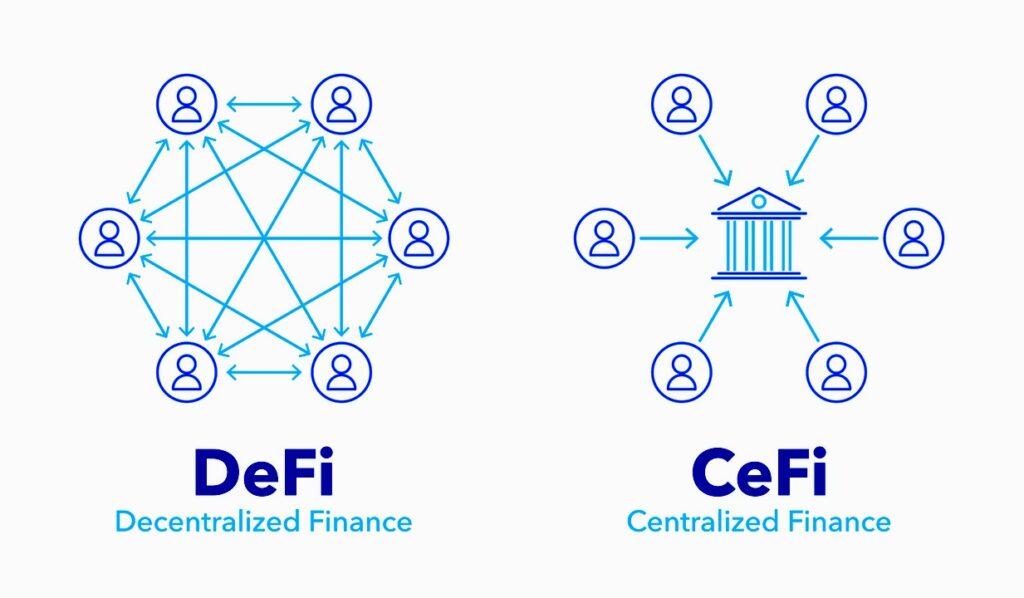

Decentralized Finance (DeFi) refers to a system of financial services built on blockchain technology that operates without the need for traditional intermediaries like banks, brokers, or insurance companies. Using blockchain’s decentralized ledger system, DeFi platforms allow users to engage in activities like lending, borrowing, trading, and investing, all in a peer-to-peer (P2P) environment.

In DeFi, blockchain ensures the security, transparency, and immutability of financial transactions, allowing individuals to retain control over their financial assets and transactions. Smart contracts, which are self-executing contracts with predefined rules coded into them, are used to automate transactions and enforce the terms of agreements.

Blockchain: The Backbone of DeFi

At the heart of DeFi lies blockchain technology, a distributed ledger that securely records transactions across a network of computers. Blockchain is key to enabling DeFi platforms to function without the need for trusted intermediaries. Blockchain provides a transparent, immutable, and secure environment for all DeFi transactions, ensuring that each transaction is verifiable and resistant to fraud.

- Security: Blockchain’s cryptographic algorithms make it nearly impossible for any unauthorized parties to alter transaction data, ensuring security.

- Transparency: Every transaction recorded on the blockchain is visible to all participants in the network, promoting transparency.

- Decentralization: Unlike traditional financial systems, blockchain’s decentralized structure ensures that no central authority controls the transactions or the financial ecosystem.

The Key Benefits of DeFi and Blockchain Technology

- Increased Accessibility

One of the most exciting aspects of DeFi is its potential to increase financial inclusion. Traditional banking services are often inaccessible to large segments of the population, especially in developing countries or rural areas where banking infrastructure is limited. Through blockchain technology, DeFi platforms enable individuals to participate in the global financial ecosystem without needing a traditional bank account.

- Benefits:

- Access to financial services for unbanked and underbanked populations.

- Global participation: Anyone with internet access can engage in DeFi platforms, regardless of location or socioeconomic status.

- Lower Fees and Faster Transactions

Traditional financial systems often involve multiple intermediaries, each of whom charges fees for processing transactions, which can slow down the overall process. Blockchain-based DeFi platforms eliminate these intermediaries, reducing transaction fees and speeding up the transfer of assets.

Smart contracts automate processes like lending, borrowing, and exchanging, making transactions quicker and more cost-efficient. For example, transferring money across borders through traditional banking channels can take several days and incur high fees. With blockchain, these same transactions can be completed in minutes and with lower costs.

- Benefits:

- Faster transactions: Blockchain’s ability to execute transactions quickly and securely eliminates delays associated with traditional systems.

- Lower transaction costs: By removing middlemen, DeFi significantly reduces transaction fees.

- Transparency and Security

Blockchain technology’s core feature is its ability to provide transparency and security. Every transaction on the blockchain is publicly recorded on a decentralized ledger, which anyone can verify. This level of transparency ensures that all users have access to the same information, reducing the risk of fraud, corruption, and manipulation.

Moreover, blockchain’s cryptographic techniques ensure that transactions are secure, reducing the risk of fraud and data breaches often associated with centralized systems.

- Benefits:

- Transparent transactions that can be audited by anyone in the network.

- Immutability: Once a transaction is recorded on the blockchain, it cannot be altered or deleted.

- Enhanced security through cryptography.

- Greater Control and Ownership

In traditional financial systems, users must trust intermediaries (banks, brokers, insurance companies) to manage their assets and transactions. In DeFi, users have full control over their financial activities, including their assets, investments, and transactions. Through non-custodial wallets, individuals can store their assets securely without relying on third-party institutions.

- Benefits:

- Self-custody: Users have control over their assets and private keys.

- No reliance on intermediaries: DeFi empowers users by eliminating the need for banks or brokers.

Popular DeFi Use Cases in Finance

- Decentralized Lending and Borrowing

DeFi platforms enable users to lend and borrow cryptocurrencies or digital assets directly with one another through smart contracts, eliminating the need for traditional financial institutions. Lenders earn interest on their deposits, while borrowers can access funds without going through credit checks or banks.

- Decentralized Exchanges (DEXs)

Decentralized exchanges (DEXs) allow users to trade cryptocurrencies and digital assets without the need for centralized exchanges like Binance or Coinbase. By using liquidity pools and smart contracts, DEXs enable users to swap assets directly in a secure, decentralized environment.

- Yield Farming and Staking

Yield farming and staking are investment strategies available on DeFi platforms that allow users to earn passive income by locking their digital assets in liquidity pools or staking them on the blockchain. These strategies offer attractive returns, albeit with some risks associated with the volatile nature of digital assets.

Challenges of DeFi and Blockchain

While DeFi and blockchain technology offer numerous advantages, there are also challenges to consider:

- Scalability: Blockchain networks, especially Ethereum (which is widely used for DeFi), face scalability issues when handling large volumes of transactions. This can lead to network congestion and increased gas fees.

- Regulatory Uncertainty: The decentralized nature of DeFi raises regulatory concerns. Governments and financial authorities are working to establish clear rules and frameworks for the use of DeFi platforms.

- Security Risks: While blockchain is highly secure, vulnerabilities in smart contracts or DeFi protocols can lead to exploits and hacks, resulting in significant losses for users.

The Future of DeFi and Blockchain

The future of DeFi and blockchain technology is promising. As more people adopt decentralized financial systems, the demand for decentralized applications (dApps) and blockchain-based services will continue to rise. With further advancements in scalability, regulation, and security, DeFi will likely become an integral part of the global financial ecosystem.

Moreover, the continued innovation in blockchain technology will pave the way for new applications and opportunities, reshaping not only finance but also industries like insurance, real estate, and supply chain management.

Also Read: Blockchain In Finance: Revolutionizing Payments, Banking, And Beyond

Conclusion

Decentralized Finance (DeFi), powered by blockchain technology, is ushering in a new era of financial innovation. By eliminating intermediaries, reducing fees, increasing transparency, and offering more control to users, DeFi is reshaping the way we think about financial services. While challenges remain, the potential of DeFi to enhance financial inclusion, security, and efficiency makes it an exciting and transformative force in the financial world.

As blockchain technology continues to evolve, DeFi platforms will likely become more scalable, user-friendly, and secure, offering even greater opportunities for financial innovation and access to financial services for everyone, anywhere.